Issue #5: What Makes a World Reserve Currency?

Part 2: The Global Repo Market and Cross-Border Dollar Funding

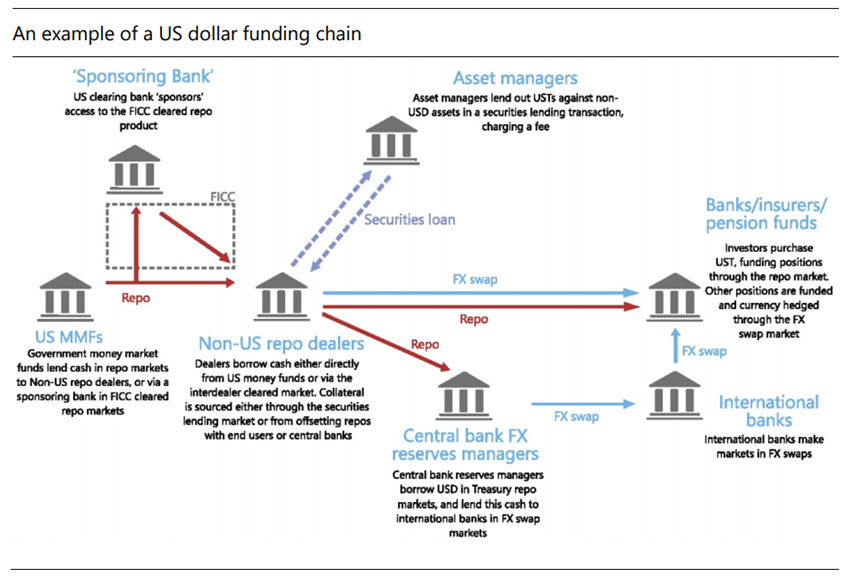

This week’s research note builds on last week’s research note, which elaborates on the role of US dollar FX swaps in the global funding of both financial and non-financial institutions. The repo market is another important source of financing for leveraged institutions, as well as facilitating the international flow of collateral throughout the global financial system.

While we lack detailed statistics, the size of the global repo market is estimated to be approximately $10-20 trillion, with an average daily turnover of more than $2 trillion.1 2 3

I usually refer to the global, bilateral portion of the repo market (as opposed to the US, tri-party portion of the repo market) in my discussions of the repo market. The global repo market is a bilateral repo market and is consequently relatively opaque. More importantly, the global bilateral repo market is also where collateral rehypothecation is not limited by regulations and therefore is a more accurate representation of the market clearing price for collateral.4 This stands in stark contrast with the relatively more understood US tri-party repo market, which is only about $1-2 trillion in size (and for which we now have detailed statistics).5

About 80% of bilateral repo transactions are short-term (less than 1 month). The US portion of the bilateral repo market, at about $3-5 trillion, including securities lending, is designed primarily to seek out and mobilize specific collateral, primarily US treasuries.6 More than 80% of US bilateral repo transactions use US treasuries as collateral.7 8

Surprisingly, even in the European repo market (at about $10 trillion outstanding), US dollar-denominated repo transactions make up 20-30% of total repo outstanding, making the dollar the second most common currency after the euro. Moreover, US treasury and agency collateral is the second most used collateral in European repo transactions after German bunds (12% vs. 13.3%).9

Similarly, even in the UK repo market, US treasuries command an equivalent or sometimes even lower haircut than the securities of other governments, such as British, German, and French bonds.10

As suggested earlier, repo is another channel through which global financial institutions can acquire dollar funding.

In the US, there are several repo markets with very important distinctions:

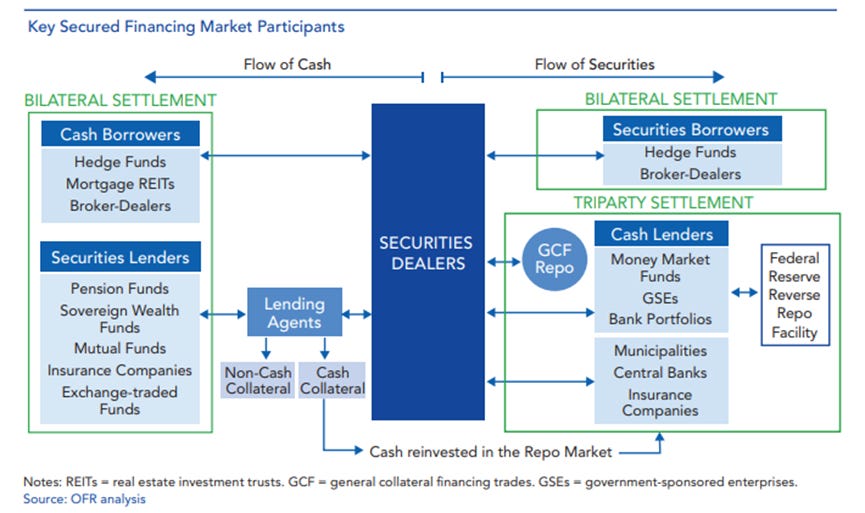

Tri-Party – approximately $1-2 trillion, down from pre-2008 $3 trillion.11 The tri-party repo market involves US Primary Dealers (“dealers”) and Money Market Funds (MMFs). Dealers fund their daily inventory by repoing out their holdings of government bonds and agency MBS to MMFs, which provide cash funding. In the tri-party repo market, clearing and settlement occur through a settlement system that provides services to make sure that the terms of the repo contract are met. The cash lender and cash borrower post cash and collateral, and neither the cash nor the collateral leave the custody of the tri-party platform during the course of the day. Thus, collateral pledged in the tri-party repo market is “locked in” and unavailable for repledging to the broader financial system. While the Bank of New York Mellon provides collateral management services, they do not function as a central counterparty.

GCF Repo – interdealer/interbank market where smaller dealers and foreign banks fund their inventory. Primary dealers typically operate here with a matched book (net lending = net funding). Net lenders are typically domestic banks and GSEs. GCF repo, which operates within the tri-party structure, has access to collateral management and tri-party custodian services. However, unlike the rest of the tri-party system, the DTCC serves as a central counterparty.

Bilateral – funding and collateral provided to and from a range of financial institutions including but not limited to dealers, banks, hedge funds, money market funds, pension funds, insurance companies, foreign central banks, etc.

Cleared Bilateral – DvP (Delivery vs. Payment)

Brokered/Unbrokered

Sponsored Borrowing/Lending – in these segments, sponsoring clearing members bring in sponsored counterparties, allowing dealers to transact with a more diverse set of borrowers and lenders than that typically allowed to access the FICC’s central counterparty service. Examples of some sponsored counterparties include hedge funds, money market funds, other asset managers, and smaller banks.

Uncleared Bilateral – the primary source of borrowing for hedge funds. There is very limited data collection about this specific segment of the repo market.

Securities Lending/Borrowing – pension funds, insurance companies, sovereign wealth funds, asset managers (including ETFs) – collectively known as “collateral silos,” as well as banks/broker-dealers lend out securities, which are used by hedge funds, pension funds, and banks/broker-dealers in order to post initial margin, fund balance sheets, cover short positions, etc. Motivation for securities lending in the post-GFC era has been at least partially motivated by “reach for yield.”12 The lower end estimate of the total securities lending market is about $10 trillion, with about $1 trillion outstanding at any given time.13

Securities Lending against Cash Collateral – i.e. the lending out of collateral to receive extra yield. The securities lender receives cash collateral for the duration of the loan, which is typically invested in money markets.

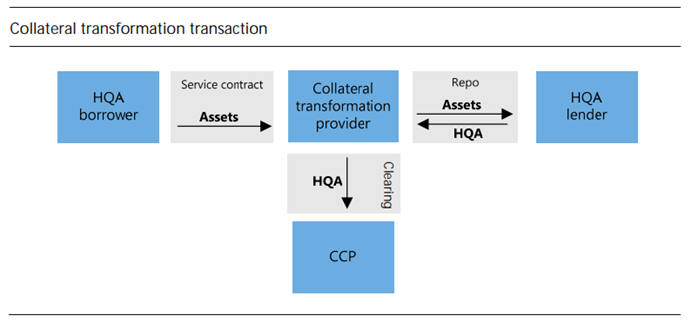

Securities Lending against Non-Cash Collateral – a.k.a. “collateral transformation” or “collateral upgrades.” Securities lending against non-cash collateral is partially motivated by new initial margin requirements which prefer the posting of US Treasuries as initial margin to central counterparties in order to engage in OTC derivative transactions. USTs can be exchanged for other types of collateral, including MBS, IG corporate bonds, junk corporate bonds, EM debt, CLOs, etc. This type of transaction is analogous to a collateral swap, but the lender of USTs is compensated in the form of steep haircuts. This type of lending comprises about half of the US securities lending market, and about half of US treasuries and agencies on loan are against non-cash collateral.

The effect of a reverse repo is economically equivalent to a securities lending transaction, but they are classified differently due to differences in their emphasis and legal/contractual protections. Securities lending transactions favor the securities lenders. Repo transactions favor the cash lenders (as opposed to the securities lenders).

The estimated size of the global bilateral repo market has significantly decreased since 2008, demonstrated by the decline in collateral velocity, decline in eligible collateral, and increase in haircuts, but its actual size, as well as the extent of its destruction, are unknown.14

The bilateral repo market can be described as a market for collateral, incidentally against cash. The tri-party repo market, on the other hand, can be described as a market for funding, incidentally against collateral.15

The more important (and less understood) market is the bilateral repo market, as it is here where collateral reuse is unrestricted and not confined to one jurisdiction, making it global and allowing it to affect all types of financial institutions. Rough estimates indicate that the global bilateral repo market’s size is between $10-20 trillion, but the truth is that these numbers are most likely extremely understated, because data collection and reconciliation efforts have been seriously lacking and downright absent at times (particularly for securities lending and uncleared bilateral repo).

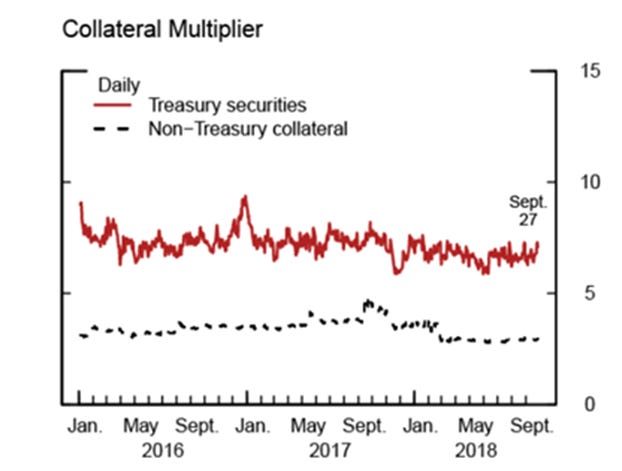

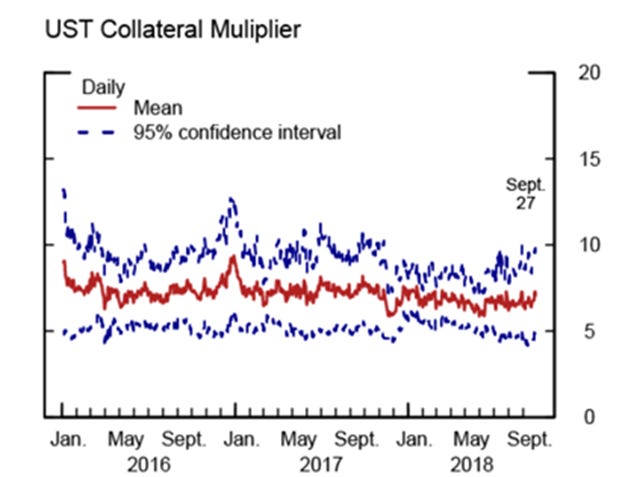

We first start by observing that US treasury collateral is typically reused at least 5-15x.16 Other types of collateral are reused less, around 3-5x.

Between 1980 and 2008, the use of collateral in financial markets globally rose exponentially, both at home in the US and abroad. Securitization and repo rose in tandem as repo provided the means to fund expansions of bank balance sheets while securitization provided liquid and tradable assets to pledge in repo.17 The crisis has resulted in a reduction of the pool of assets considered acceptable as collateral, resulting in a liquidity shortage.18 Furthermore, the interbank unsecured market (composed of Federal Funds and commercial paper) has all but completely dried up, falling to 25% of its pre-crisis levels, causing large domestic banks to rarely, if ever, make use of it anymore.19 20 21

Collateral serves several critical functions in the global financial system: it can be used to quickly raise funds through secured financing transactions (i.e. repo), to satisfy margin requirements on OTC derivatives positions, or to satisfy regulatory ratios (i.e. LCR ratio). As a direct consequence of the decline of unsecured interbank lending, collateralized borrowing has taken on a special role in today’s banking system. Repo is essential to how dealers finance their own inventories and their prime brokerage clients’ assets.

There are several factors that influence the total “effective” collateral supply:

Haircuts

“Base” collateral availability

Reuse/Repledging/Rehypothecation

While all are significant (and tend to be correlated), changes in collateral reuse have the largest (and most rapid) effect out of the three.

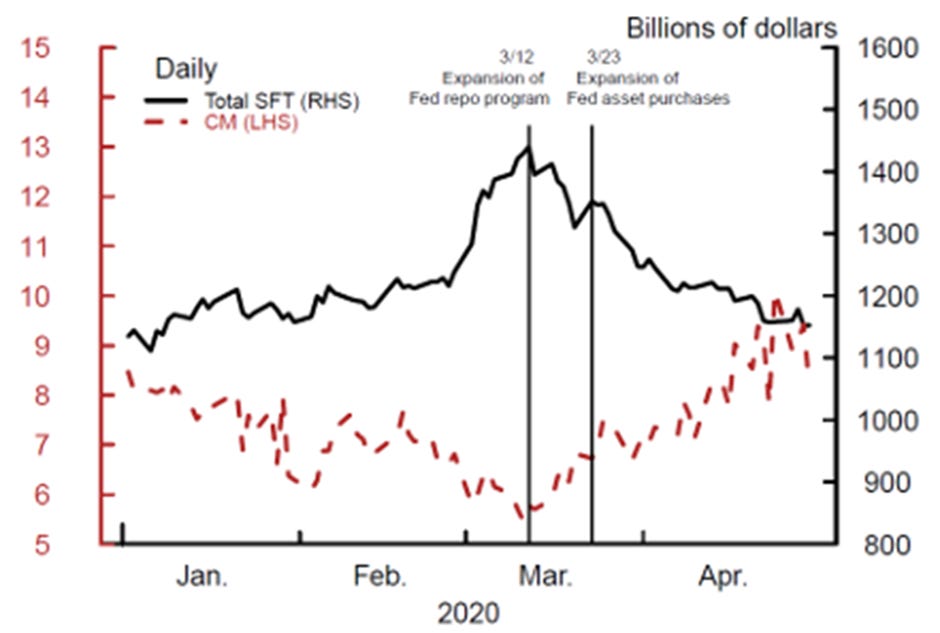

Dealer repledging/rehypothecation is driven by risk perceptions – it is only natural that when dealers’ perceptions of risk begin to rise, dealers respond by limiting reuse due to counterparty risk. This has already been demonstrated via an approximately 50% drop in collateral velocity after Lehman Brothers.22 Indeed, that is also what we saw in March 2020 – an extreme example of collateral shortage in the repo market.23

An excerpt from the March 15, 2020 Federal Reserve Meeting Minutes:

Conditions in short-term funding markets also deteriorated sharply amid a decline in market liquidity and challenges in dealer intermediation. Over recent days, the premium paid to obtain dollars through the foreign exchange swap market increased sharply, and the volumes in term repurchase agreement (repo) markets dropped significantly. Issuance of commercial paper (CP) maturing beyond one week reportedly almost dried up at the end of the week before the meeting, and primary- and secondary-market liquidity for financial and nonfinancial CP was described as nearly nonexistent at a time when investor concern about issuer credit risk was rising…

In the Treasury market, following several consecutive days of deteriorating conditions, market participants reported an acute decline in market liquidity. A number of primary dealers found it especially difficult to make markets in off-the-run Treasury securities and reported that this segment of the market had ceased to function effectively. This disruption in intermediation was attributed, in part, to sales of off-the-run Treasury securities and flight-to-quality flows into the most liquid, on-the-run Treasury securities.24

Consequently, it is inarguable that both the global repo and FX swap markets perform critical functions in lubricating cross-border financial flows between market participants, especially in a world that is structurally short US dollars. Although reserves serve as money for banks, it is arguable that collateral, not deposits, serve that same role but for non-bank financial institutions. This occurs because collateral, which can be owned and used by a wide range of counterparties across the world, is often more liquid than money itself.

In this research note, I have provided a brief overview of some of the major segments of the global repo market, with a particular emphasis on the global role of US treasuries as repo collateral. In future issues of Monetary Mechanics, I will dive more deeply into specific parts of the US repo market (i.e. GCF repo, sponsored repo, tri-party repo, etc.), as well as foreign repo markets (i.e. the European and Japanese ones).

BIS Committee on the Global Financial System no. 65 “US Dollar Funding: An International Perspective” June 2020.

Gary B. Gorton, “Securitized Banking and the Run on Repo,” National Bureau of Economic Research, August 2009.

Manmohan Singh and Peter Stella, “Money and Collateral,” IMF Working Paper, April 2012.

Manmohan Singh, “Velocity of Pledged Collateral,” IMF Working Paper, November 2011.

https://libertystreeteconomics.newyorkfed.org/2015/10/the-tri-party-repo-market-like-you-have-never-seen-it-before/

Baklanova et. al., “The US Bilateral Repo Market: Lessons from a New Survey,” Office of Financial Research, January 2016.

Copeland et. al., “The Use of Collateral in Bilateral Repurchase and Securities Lending Agreements,” Federal Reserve Bank of New York Staff Report No. 758. January 2016. Revised October 2017.

https://www.financialresearch.gov/briefs/files/OFRBr_21-01_Repo.pdf

https://www.icmagroup.org/assets/documents/Regulatory/Repo/Surveys/ICMA-European-repo-market-survey-number-40-conducted-December-2020-230321v2.pdf

https://ktodorov.com/files/research/UK_Repo_Haircuts_Todorov_et_al.pdf

Copeland et. al., “Key Mechanics of the Tri-Party Repo Market,” New York Federal Reserve Quarterly Review, 2012.

https://www.federalreserve.gov/newsevents/speech/files/stein20130207a.pdf

Baklanaova et. al., “A Pilot Survey of Agent Securities Lending Activity,” Office of Financial Research, August 2016.

Manmohan Singh, “Velocity of Pledged Collateral,” IMF Working Paper, November 2011.

Manmohan Singh, “The (Sizable) Extent of Rehypothecation in the Shadow Banking System,” IMF Working Paper, 2010.

https://www.federalreserve.gov/econres/notes/feds-notes/ins-and-outs-of-collateral-re-use-20181221.htm

Gary B. Gorton, “Securitized Banking and the Run on Repo,” National Bureau of Economic Research, August 2009.

Manmohan Singh, Collateral and Financial Plumbing, Risk Books, 2016.

Carolyn Sissoko, “The Collateral Supply Effect on Central Bank Policy,” August 21, 2021.

https://fedguy.com/the-on-rrp-will-never-be-a-floor/

https://apps.newyorkfed.org/en/markets/autorates/fed%20funds

Manmohan Singh, “Velocity of Pledged Collateral,” IMF Working Paper, November 2011.

Sebastian Infante and Zack Saravay, “What Drives U.S. Treasury Re-Use?,” Finance and Economics Discussion Series 2020-103. Washington: Board of Governors of the Federal Reserve System, https://doi.org/10.17016/FEDS.2020.103.

https://www.federalreserve.gov/monetarypolicy/fomcminutes20200315.htm

".......which are used by hedge funds, pension funds, and banks/broker-dealers in order to post initial margin, fund balance sheets, cover short positions, etc......."

I definitely cannot understand this sentence. Why should a pension fund need to borrow stocks? AFAIK they are buying stocks for the long term, hence they should be on the lenders' side..