Issue #35: USD/CNY Update – Chinese Yuan/Renminbi Carry Trade

In a recent issue of Monetary Mechanics, Issue #21, from September 27, 2021, I outlined the likelihood that the Chinese renminbi (RMB) would underperform the US Dollar over the next 12 months. While I believe that the structural factors that were outlined in that research report are still valid, I would like to provide an update on my forecast of the future, after taking into consideration recent relevant market structure changes, as well as other new information that has also come to light.

USD/CNY Exchange Rate since September 27, 2021

Since the initial release of Issue #21 of Monetary Mechanics, the USD/CNY exchange rate has dropped approximately 0.9% from 6.44 to 6.37.

I believe, if anything, that the fundamental factors lean more in my favor today than they did 2 months ago, despite the slight appreciation of the Chinese RMB in the short-term. In addition, I believe that the People’s Bank of China (PBOC) easing monetary policy and the Federal Reserve preparing to tighten monetary policy are also fundamental factors that appear to be in my favor regarding this matter.

However, there is the possibility that the Chinese RMB would continue to strengthen in the near-term, at least over the next couple of months, as long as Chinese exporters convert their US Dollars to Chinese RMB towards the end of the year and economic conditions for the “Chinese RMB carry trade” remain favorable for investors.

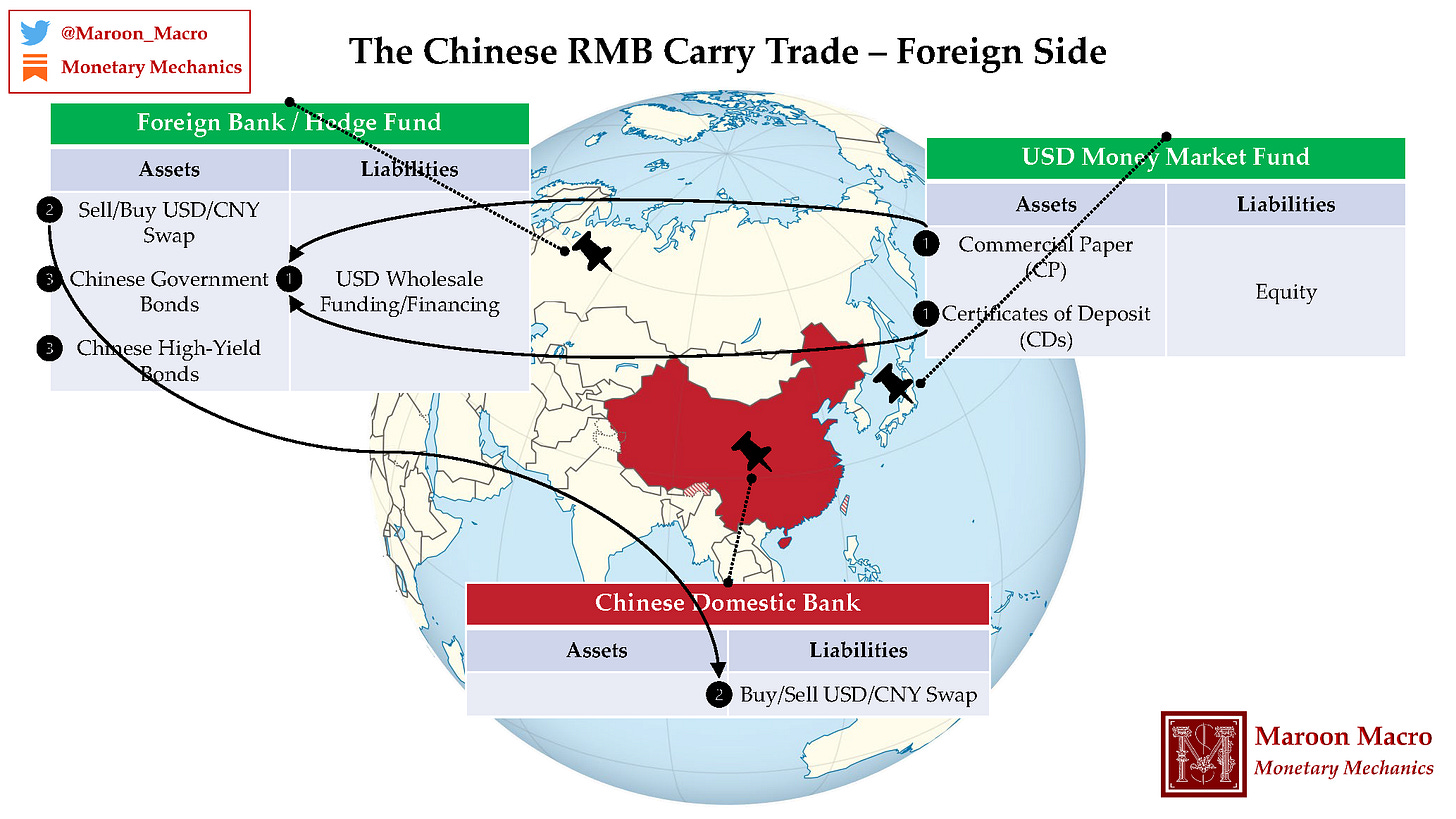

Chinese RMB Carry Trade

The “Chinese RMB carry trade” is one of the driving mechanisms behind the significant strength of the Chinese RMB over the past 12-18 months. In summary, it involves various financial institutions, both domestically (in China) and internationally (outside of China), taking advantage of the interest rate differential between the interest rates in China and the rest of the world. These financial institutions drive the appreciation of the Chinese RMB relative to foreign currencies by borrowing in a foreign currency (like the US Dollar), swapping into Chinese RMB, and purchasing Chinese assets. These financial institutions are able to profit from the interest rate differential between the interest rates in various countries, as well as from the appreciation of the Chinese RMB, as long as the trend stays in their favor.

However, this precipitates a problem, as the buildup of leverage in the Chinese RMB carry trade ultimately becomes unsustainable. The turnover of overnight repurchase agreements (overnight repo) has risen above ¥4 trillion (approximately $626 billion) for much of the past 2 months.1 This high of a turnover volume is often associated with a buildup of leverage in the interbank market, as repurchase agreements (repo) are one of the most popular methods for financial institutions to fund/finance purchases of fixed income securities, such as government and corporate bonds. In this type of economic environment, the Chinese RMB carry trade of borrowing cheaply in the interbank market and buying high-yield bonds is extremely lucrative.

China interbank pledged repo daily turnover rate has been high for much of the past few months, revealing a buildup of leverage in the Chinese RMB carry trade

Kang Chen, a fixed income analyst at Northeast Securities Co., states that “as long as there’s room to make a profit from this carry trade, investors will feel motivated to add leverage.”2 According to Guosheng Securities Co., non-bank financial institutions (e.g. brokerages and fund managers) have been the main drivers behind the increase in repurchase agreement (repo) transactions.3

If leverage continues to climb, the People’s Bank of China (PBOC) may feel compelled to clamp down once again, as the Chinese central bank has demonstrated in the past that one of its major objectives is to prevent the buildup of bubbles in the bond market in order to maintain financial stability. Ming Ming, the head of fixed income research at CITIC Securities, in describing the increase in leverage carry trades as “the biggest hidden trouble” of the bond market, anticipates that the People’s Bank of China (PBOC), as the Chinese central bank, may tighten monetary policy to control the magnitude of these repurchase agreement (repo) transactions.4

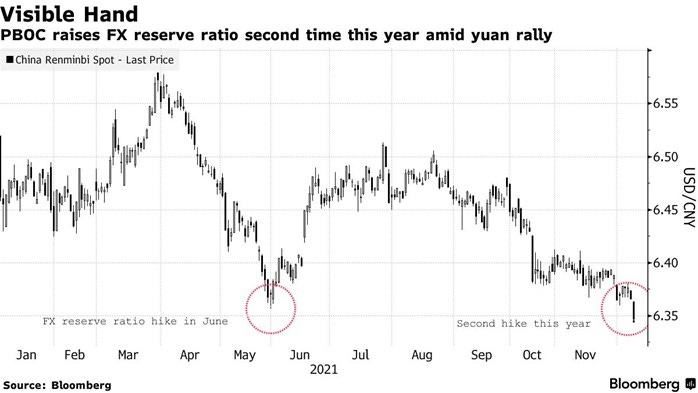

In fact, the People’s Bank of China (PBOC) did decide to clamp down on this type of carry trade, just last week, on December 15, 2021, after it increased the foreign exchange (FX) reserve requirement ratio (RRR) for Chinese banks. The PBOC hiked the reserve ratio on foreign exchange holdings of Chinese banks from 7% to 9%, which was the second such increase this year. The reserve ratio hike, designed by the PBOC to help liquidity management, effectively decreases the supply of US Dollars and other currencies onshore, putting pressure on the Chinese RMB to weaken.5

This hike essentially discloses the growing discomfort of the People’s Bank of China (PBOC) with the Chinese RMB’s strength, as well as the buildup of leverage in the Chinese RMB carry trade.

This hike happened after the China Foreign Exchange Committee (CFEC), an organization formed by key participants in China’s foreign exchange market and functioning under the guidance of China’s central bank, encouraged lenders to hedge their foreign exchange exposure, as well as called for banks to better track their proprietary trading and refine their risk management. This hike is just one of the latest signs that Beijing is getting anxious about a rapid rise in the strength of the Chinese RMB, as well as about leveraged bets on the Chinese RMB’s continued strength.6

Specifically, the China Foreign Exchange Committee (CFEC) informed banks that if the volume of their proprietary trading increases 50% from a year earlier or exceeds 15 times the amount that they execute on behalf of their customers/clients, their businesses will be further investigated and analyzed. Stephen Jen, the Chief Executive Officer and Co-Chief Investment Officer of Eurizon SLJ Capital, argues that the People’s Bank of China (PBOC) “will find ways and other measures to thwart the market’s ability, capacity, and willingness to go long renminbi,” and that, even though their success was ambiguous in the short run, past Chinese endeavors and maneuvers to arrest Chinese RMB strength eventually proved successful in the long run.7