Issue #44: The Russia-Ukraine Crisis and its Ramifications for Global Supply Chains and Global Commodities Markets

While I am admittedly far from an expert on supply chains and commodities markets, I believe that, given the recent escalation of the Russia-Ukraine conflict, it would be interesting and timely for me to share some of the research that I have done, as well as my opinions, on this topic. If there are other people out there who are better informed about these issues than me, as always, I would be happy to hear from them and further discuss/debate these issues with them.

What does the Russia-Ukraine crisis, particularly the potential sanctioning of Russian financial institutions, mean for the rest of the world? Let’s begin this conversation with a brief overview of Russia’s and Ukraine’s importance to the global economy.

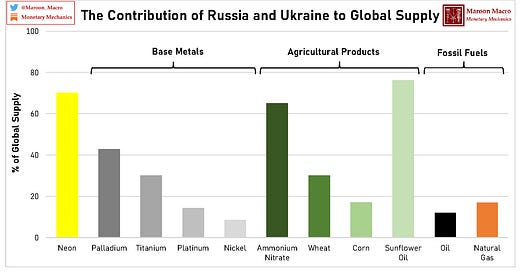

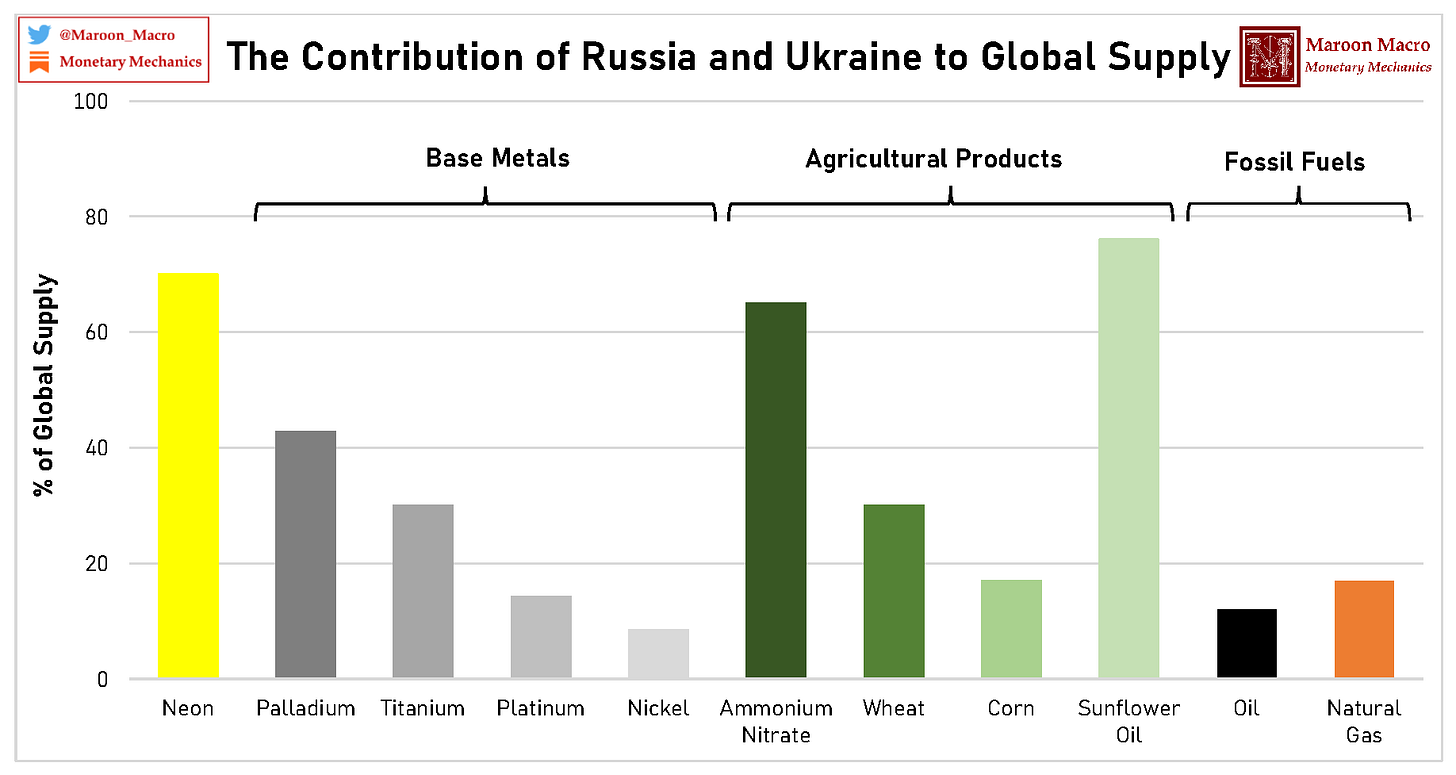

Russia and Ukraine are significant producers of several key commodities including:

Noble gases such as neon, argon, krypton, and xenon

Base metals such as steel, copper, nickel, aluminum, platinum, titanium, palladium, and zinc

Fossil fuels such as oil and natural gas

Agricultural products such as wheat and corn

Ammonium nitrate

Russia’s and Ukraine’s Production of Noble Gases

Noble gases such as neon, argon, krypton, and xenon are key components of the manufacturing process for semiconductors, as they are used to produce excimer gas mixtures in lasers that are used to create semiconductor chips. In fact, semiconductor chip fabricators account for more than 90% of global neon consumption. Virtually all semiconductors made around the world (approximately 75-90%) utilize a manufacturing process that necessitates the use of neon gas.1

Neon is a by-product of steel manufacturing, so Ukrainian neon gas producing and purifying firms rely heavily on neighboring Russian steel manufacturers. Neon gas is produced in Russia and purified in Ukraine.

Over 70% of the worldwide supply and 90% of the US supply of semiconductor-grade neon gas comes from three Ukrainian companies: Iceblick, Ingas, and Cryoin. Over 65% of the worldwide supply comes from Iceblick alone, which is a company that is located in Odessa, Ukraine. There are obviously other long-term sources of neon in Africa, but that is irrelevant in the short term.

The total cost of these noble gases (neon, argon, krypton, and xenon) accounts for approximately 5-6% of the total cost of integrated circuit materials.2

According to industry sources, “even if there was a conflict in Ukraine it wouldn’t cut off supply. It would drive prices up. The market would constrict. Those gases would become pretty scarce, but it wouldn’t stop semiconductor manufacturing.”3 This is largely because semiconductor manufacturers have elevated levels of neon gas supplies relative to historical norms due to COVID-19 pandemic-related supply chain disruptions. This may seem counterintuitive to some people. For the past two years, semiconductor manufacturers double or triple ordered, buying a larger than usual backlog of inputs, due to the uncertain availability and accessibility of materials.

According to a semiconductor analyst at Citibank, “memory [chip] makers currently hold six-to-eight weeks of inventory of these critical gases, higher than the normal level of four weeks. Supply of these gases is highly dependent on Ukraine, and any disruptions to output arising from military action in the region could lead to semiconductor production being severely impacted.”4 Thus, larger than usual neon gas supplies at semiconductor manufacturers should fortuitously absorb and blunt the negative impact of the Russia-Ukraine crisis, for a bit, but definitely not forever.

During the previous Russia-Ukraine crisis in 2014, when Russia annexed the Crimean Peninsula, neon gas prices increased approximately 7-10x.

Russia’s and Ukraine’s Production of Base Metals

Russia produces 43% of global palladium and is also a significant producer of other industrial metals including steel, copper, nickel, aluminum, platinum, titanium, and zinc.5

Palladium is primarily used in the automobile and electronics industries to produce catalytic converters, sensors, and memory chips. However, unlike the production of neon and other noble gases, there are other significant producers of palladium, such as the United States, Canada, and South Africa. Combined, the production of these three countries exceeds the production of Russia, meaning that the continued supply of palladium should not be a big cause for concern.6

Global Mine Production of Palladium from 2010 to 2020

The world’s largest producer of titanium is VSMPO-AVISMA, which is a plant that is located in the “Titanium Valley” of Western Siberia. Russia and Ukraine together account for 30% of the global supply of titanium, but this understates their hegemony over the global supply chain.

Titanium is primarily used in the production of disks, frames, and jet engines, due to its resistance to heat and corrosion, as well as due to its ratio of weight to strength.

The US Bureau of Industry and Security released a report back in October 2021, warning that VSMPO-AVISMA was providing titanium sponge to its buyers in the US at “artificially low” prices, with Russian state support, causing it to capture a “significant share of Boeing’s business.” Boeing, ignoring it, soon committed to even stronger ties with the company.7

In effect, Russia has been doing what China did earlier with rare earth metals, which is establishing a foothold by selling below cost and knocking out the Western supply chain. The aforementioned report remarked that Russia would be able to wield this dominance “as a tool of geopolitical leverage.” In addition, the aforementioned report also remarked that the US is down to only one aging plant capable of producing titanium sponge at scale, and that the US no longer has any titanium reserve in the National Defense Stockpile.8

Russia’s and Ukraine’s Production of Agricultural Products and Ammonium Nitrate

On February 2, Russia banned export of ammonium nitrate for two months, until April 2. Ammonium nitrate is used as a fertilizer in agriculture. As Russia accounts for approximately ⅔ of global ammonium nitrate production, such an export ban can cause significant increases in global wheat, corn, food, and cotton prices.9 10 Moreover, Russia usually exports up to 50% of its fertilizer-grade ammonium nitrate, with most of this going to Europe. As a consequence, the cost of nitrogen fertilizers has more than doubled, from $300 per ton last year to $1,300 per ton this year. Russia and Ukraine together are also responsible for almost 30% of global wheat exports.

Russia’s and Ukraine’s Production of Energy

Russia is a significant supplier of both oil and natural gas, with major supply pipelines running directly through Ukraine. On the energy front, the Russia-Ukraine crisis is not immediately very impactful to the United States, as the United States only imports oil in limited quantities from Russia and has its own large domestic supply of natural gas. However, the Russia-Ukraine crisis has been and will continue to be disruptive to global energy markets.

The Nord Stream 2 pipeline, a natural gas pipeline running from Russia to Germany through the Baltic Sea, was completed in September 2021. As of now, the pipeline has never been active and has been suspended by the German government over Russia’s invasive actions in Ukraine. The pipeline is designed to double the supply of natural gas that Russia sends over to Germany, with the latter currently sourcing an estimated 50% of its existing supply of natural gas from the former.

In the first half of 2021, Germany produced approximately 17% of its electricity from natural gas. However, partially because of its recent efforts to transition to cleaner and more renewable forms of energy, its energy grid has been lacking a reliable source of invariable production (i.e. production that can be turned on/off at will).11 Inevitably, Germany’s retail electricity prices have increased approximately 25% over the past year. Consequently, Germany’s general electricity prices, currently at €0.32 per kilowatt hour, are some of the highest in Europe.12

Conclusion

There is currently a lot of noise surrounding the ramifications that the Russia-Ukraine crisis may have for global supply chains and global commodities markets. I believe that, even absent a weaponization of exports and an escalation of sanctions, it is likely that disruptions to global supply chains and global commodities markets will cause inflation to become somewhat more persistent than was previously estimated. The magnitude and duration of the negative impact are, as of now, extremely uncertain, as they depend largely on the collateral damage to the civilian infrastructure, the responses of the Western allies, and the overall duration of the occupation.

In a nutshell, we are going into a volatile period, of which there are three key contributing factors:

The weight of Russia in the global supply chains and the global commodities markets

The exposure of Europe to Russian noble gas, base metal, agricultural, and energy imports, as well as its involvement in the Russia-Ukraine conflict in the near future

Very tight global supply chains and global commodities markets that have already been significantly stressed by the COVID-19 pandemic

I believe that the most important things to watch out for will be the supply of neon gas, as that could exacerbate existing semiconductor production problems, and the supply of agricultural products and ammonium nitrate, as that could exacerbate existing food supply chain problems.

https://www.trendforce.com/presscenter/news/20220215-11119.html

https://www.tellerreport.com/news/2022-02-15-american-semiconductor-is-also-stuck-in-the-neck--neon-gas-supply-may-be-cut-off-amid-russia-ukraine-conflict.r1VqUpdJc.html

https://www.reuters.com/technology/white-house-tells-chip-industry-brace-russian-supply-disruptions-2022-02-11/

https://www.cips.org/supply-management/news/2022/february/chip-makers-need-to-look-for-suppliers-outside-ukraine-/

https://fortune.com/2022/02/14/russia-ukraine-semiconductor-shortage/

https://www.statista.com/statistics/1233033/mine-production-of-palladium-worldwide/

https://www.bis.doc.gov/index.php/documents/regulations-docs/federal-register-notices/federal-register-2021/2863-86-fr-59115/file

https://www.bis.doc.gov/index.php/documents/regulations-docs/federal-register-notices/federal-register-2021/2863-86-fr-59115/file

https://tass.com/economy/1396223

https://www.spglobal.com/commodity-insights/en/market-insights/latest-news/agriculture/020222-russia-bans-ammonium-nitrate-exports-until-april-to-support-domestic-farmers

https://www.cleanenergywire.org/factsheets/what-german-households-pay-power

https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Electricity_price_statistics