Issue #29: US Dollar Demand and Uses

There are several significant categories of international currency use:

Official sector FX reserves

Cross-border bank liabilities

International debt securities

OTC FX transactions (e.g. forwards and swaps)

The Public Sector

Official Sector FX Reserves

One of the most frequently mentioned categories of international currency use in the mainstream financial media is official sector foreign exchange (FX) reserves. Official sector FX reserves are a central bank’s holdings of cash and government securities denominated in currencies of other than that which is native to the central bank.

Central banks hold FX reserves for the purpose of maintaining stability of their countries’ financial systems, as well as maintaining relative stability of their exchange rates vis-à-vis other currencies, particularly global reserve currencies such as the US Dollar, Euro, and Japanese Yen. Central banks, by holding FX reserves, are able to buy back their own currencies whenever necessary, because one can only buy back one’s own currency with something else (i.e. a foreign currency).

While the US Dollar’s share in global FX reserves has been slightly trending downwards from 61% to 59% over the past 7 years, the US Dollar’s share in global FX reserves has also at one point swung from 61% to 66% and back again within the span of 3 short years, making it difficult to discern a definite and indisputable pattern from the data.

Furthermore, while official sector FX reserves are frequently talked about in the mainstream financial media, they only total about $12-13 trillion.1 When measured against all the other various types of foreign exchange transactions, which altogether total about $170 trillion, they seem relatively small and insignificant.

The Private Sector

The private sector accounts for the vast majority of foreign exchange transactions, both by daily turnover as well as total outstanding. The latest Triennial Central Bank Survey from the Bank for International Settlements (BIS) suggests that daily global foreign exchange trading volume is approximately $6.6 trillion.2 Basically, what this means is that private market participants will trade the value of the entire global stock of FX reserves held by central banks in the course of only 2 days.

Consequently, while official sector FX reserves are a useful tool for central bankers to attempt to fight foreign exchange movements on the margin, central bankers are also highly influenced by private market capital flows.

Cross-Border Bank Liabilities

Cross-border bank liabilities include instruments such as certificates of deposit (CDs), commercial paper (CP), large denomination time deposits, and repurchase agreements (repo). Cross-border bank liabilities specifically include those that are collected by the Bank for International Settlements (BIS) in its locational banking statistics and consolidated banking statistics data, which measure on-balance sheet bilateral positions between globally active banks in different geographic regions.

The data that I discuss here is the locational banking statistics data, which measures on-balance sheet bilateral positions between globally active banks based on individual branch location, as opposed to the residency of the parent company. For example, in the locational banking statistics data, Deutsche Bank’s US unit lending money to its parent company in Germany would be included as a US claim on German banks and as a German liability to US banks. Importantly, both the locational banking statistics and consolidated banking statistics data measure only assets and liabilities that are completely on-balance sheet. What this means is that off-balance sheet exposures and contingent liabilities such as over-the-counter (OTC) derivatives, certain types of collateral swaps, and various other off-balance sheet transactions are not included.

As of Q4 2020, cross-border bank liabilities totaled about $32 trillion. Of that $32 trillion, about 47%, which was about $15 trillion, was US dollar denominated. The Euro, as the second most used currency, was about 30%, which was about $10 trillion.

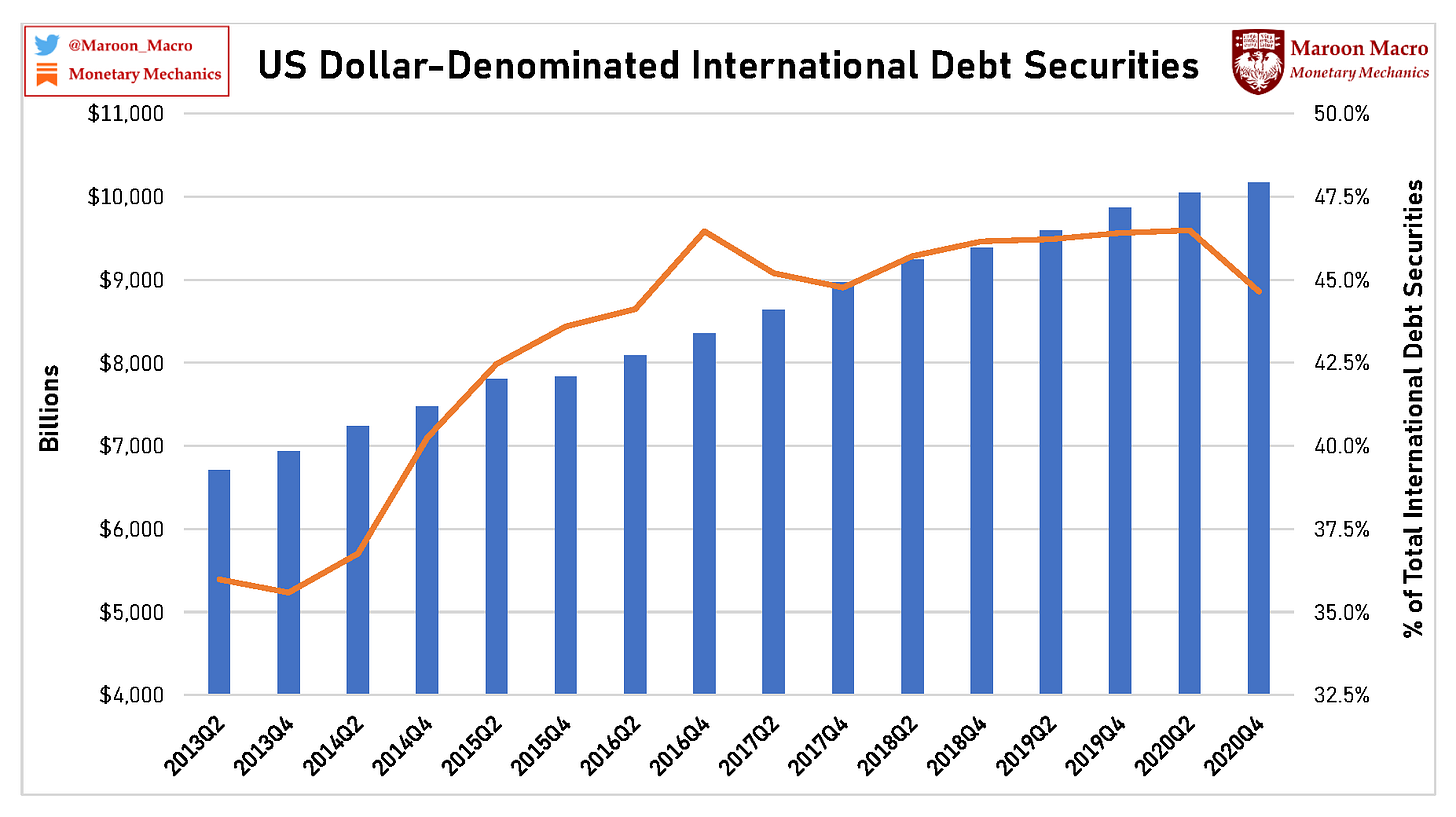

International Debt Securities

International debt securities are debt securities issued outside of the domestic market of origin in a currency denomination that is different than that of the origin country. For example, that might be China’s or a European corporate’s US dollar denominated bonds. Domestic debt securities, on the other hand, are debt securities issued within the domestic market of origin in the currency denomination of the origin country.

“Eurobonds” is another name for international debt securities, although neither the securities nor the country/corporation of origin need to reside in Europe. Hence, the name is simply an anachronism, with the prefix “euro” being a reference of “offshore,” rather than being a reference to the European common currency (the Euro), as the name predates the provenance of the Euro by several decades.

There are several important reasons why countries and corporations might choose to issue “Eurobonds.” One important reason is if investors are worried about the soundness of emerging market currencies. In such a case, issuing in a more stable reserve currency such as the US Dollar or Euro might give a greater sense of security for investors. This is the case for countries such as Argentina or Lebanon.

Another reason why countries and corporations might choose to issue “Eurobonds” is a lack of liquidity in domestic securities markets. As developed markets have the deepest and most liquid capital markets in the world, it might not be possible for a country/corporation to issue debt securities in domestic markets at attractive prices.

The US Dollar has gradually grown in prominence in the issuance of international debt securities over the past decade. As of Q4 2020, international debt securities totaled about $23 trillion, of which about 45%, which was about $10 trillion, was US dollar denominated.3 4 In 2013, as a contrast, only about 36%, which was about $6.7 trillion, was US dollar denominated. Consequently, it is clear that the Euro has gradually lost ground to the US Dollar over the past decade.

OTC FX Transactions

FX forwards and swaps constitute the most significant components of private sector FX turnover. FX forwards and swaps are key instruments in the global financial system, instrumental in hedging, position taking, and short-term funding/financing. FX forwards and swaps involve the exchange of notional amounts at a future date, and, as funding/financing vehicles, are akin to other forms of collateralized borrowing (e.g. repo).5

While the amounts involved are very large (tens to hundreds of trillions of dollars), FX forwards and swaps remain somewhat hidden due to an accounting peculiarity. FX forwards and swaps are accounted for as derivatives, rather than as collateralized debt, despite the fact that FX forwards and swaps are in fact economically equivalent to collateralized loans.6 What this means is that only a fraction of the total notional value, rather than the full notional value, is displayed on the balance sheet.

The daily turnover of FX forwards and swaps is $4.3 trillion, accounting for 65% of the daily turnover in global FX trading. FX forwards and swaps are also the fastest growing segment of FX turnover, accounting for 75% of the increase in aggregate FX turnover since April 2016 (the date of the previous survey).7 As of Q4 2020, the amount of FX forwards and swaps outstanding totaled about $98 trillion – that is almost 10x larger than the amount of FX reserves held by central banks worldwide.

The US Dollar reigns supreme in these transactions – it is almost always one of the two currencies being exchanged, accounting for 89% and 90% in terms of outstanding and turnover respectively.8

In my personal opinion, the shares of currencies involved in FX forwards and swaps is the most important indicator of how the utility of the US Dollar as a global reserve currency is evolving. This is because the over-the-counter (OTC) foreign exchange (FX) market, a market that contains deep institutional liquidity, is the only market where it is possible to move or hedge large FX exposures. The deep institutional liquidity that backs the US Dollar derives primarily from this market, slowly built up over the span of the past 7 decades. Furthermore, the function of the US Dollar as a “vehicle currency” or a common translation mechanism between different countries is obvious here – the US Dollar is on one side of almost 90% of all transactions, even though only a small fraction of these transactions begins or ends with an American entity.

Conclusion

In summary, the message is mixed. On the one hand, there are some indications that the prominence of the US Dollar as a global reserve currency is declining, such as the decline in the share of the US Dollar in the global official sector FX reserves. On the other hand, there are also other indications that the demand and uses of the US Dollar within the private sector worldwide has remained virtually unchanged over the prior decade. Furthermore, there are even some indications, such as the volume of US dollar denominated international debt securities issued, that demonstrate that the prominence of the US Dollar as a global reserve currency may even be increasing, not decreasing, contrary to public/popular opinion.

In conclusion, some specific measures to pay particular attention to include the volume of US dollar denominated FX forwards and swaps, as this is the largest and fastest growing segment of the FX market. If the share of the US Dollar in these transactions is beginning to fall substantially, then that may indicate that private market participants are beginning to lose faith in the US Dollar as a medium of exchange and a store of value that is stress resistant/resilient.

https://data.imf.org/?sk=E6A5F467-C14B-4AA8-9F6D-5A09EC4E62A4

https://www.bis.org/publ/qtrpdf/r_qt1912f.htm

https://www.bis.org/statistics/about_securities_stats.htm

https://www.bis.org/statistics/rppb2104.htm

https://voxeu.org/article/foreign-exchange-swaps-hidden-debt-lurking-vulnerability

https://www.bis.org/publ/qtrpdf/r_qt1709e.pdf

https://voxeu.org/article/foreign-exchange-swaps-hidden-debt-lurking-vulnerability

Ibid.

Great post! Any thoughts on Chinese yuan NDF’s and do you foresee a day when central banks will hold decentralized cryptocurrencies?