Issue #26: Post-GFC Financial Legislations and Regulations

In this issue of Monetary Mechanics, I am going to cover some of the most important post-GFC financial legislations and regulations that have been implemented over the past decade. I will undoubtedly gloss over some financial legislations and regulations (there are about 850 pages in the Dodd-Frank Act alone), but I will focus on those that appear the most in the financial press, as well as those that I believe are the most crucial for our understanding of the big changes that have been made to the financial system in the aftermath of the global financial crisis.

There are two major classes of financial legislations and regulations that resulted from the global financial crisis: the Basel III reforms and the Dodd-Frank Wall Street Reform and Consumer Protection Act (a.k.a. “Dodd-Frank”). The Basel III reforms were developed by the Basel Committee on Banking Supervision at the Bank for International Settlements, and are hence international in scale/scope.1

While each member country has a choice in how it enforces specific provisions of the Basel III guidelines, all member countries are expected to enforce all relevant Basel III guidelines to the internationally active banks in their respective regions. For example, the Federal Reserve has chosen to simultaneously enforce stricter versions of some Basel III guidelines for larger American banks and exempt smaller American banks from many of these same regulations/restrictions.2

On the other hand, Dodd-Frank is a piece of American legislation that applies to only domestic banks and domestic subsidiaries of foreign banks, not foreign subsidiaries of domestic banks or any international bank that is not active in the United States.

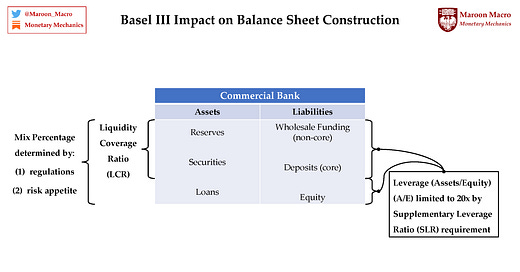

From a high-level perspective, the Basel III reforms are about capital and liquidity requirements, whereas Dodd-Frank established a number of new regulatory agencies, established the “Volcker Rule,” which subjected large internationally active banks to regular stress tests, and established new methods to more easily wind down failing financial institutions (e.g. through the drafting of “living wills”).

The Basel reforms have been around in one form or another since the 1980s (as Basel I and II). The exploitation of earlier versions of risk-weighted leverage ratios in Basel I and II was what partially caused the explosion in the use of collateralized debt obligations (CDOs), certificates of deposit (CDs), and mortgage-backed securities (MBS) in the run-up to the global financial crisis. On the other hand, Dodd-Frank is entirely new, even though some people see it as a modern-day equivalent of the Glass-Steagall Act that was repealed with the Gramm-Leach-Bliley Act in the late 1990s.