This issue of Monetary Mechanics is going to be a bit different. I have always been intensely interested in cryptocurrency and decentralized finance (DeFi), and after doing extensive research on these topics, with helpful feedback from experts in these fields, I have become cautiously optimistic about DeFi’s potential to disrupt the plumbing and architecture of the traditional financial system. While I hold no personal opinion regarding the return potential of any individual speculative cryptocurrency asset, I am highly interested in the “financial technology” behind DeFi and how it might be able to solve, either partially or fully, many of the most pressing problems that the modern monetary and banking system faces today.

I have already specified some of the major issues with our current financial system in various previous issues of Monetary Mechanics. To summarize, our current financial system requires elasticity of bank “balance sheet capacity” to facilitate economic growth. Balance sheet capacity includes not only standard on-balance sheet activity, such as extending loans and holding fixed income instruments, but also more esoteric off-balance sheet activity, such as collateral flows, hedging over-the-counter (OTC) derivatives, and other wholesale funding/financing and lending arrangements.

The expansion and contraction of these activities govern the availability of credit to the broader economy, and are particularly impactful on global trade and the activities of various industrial, manufacturing, and logistics firms, as the marginal fluctuations in the activities of these cyclical industries tend to define the peaks and valleys of economic cycles. Consequently, the continuous and consistent extension of credit lubricates the interlocking system of receivables, payables, and credit that make money and goods flow throughout the world.

The problem with the pre-GFC monetary and banking system, beginning in the 1960s, is that it began to rely on wholesale funding/financing for marginal balance sheet expansion. While wholesale funding/financing works fine in benign market environments, it has demonstrated itself to be unstable time and time again, beginning with Franklin National Bank’s declaration of insolvency in 1974 (which was, at the time, the largest bank failure in the history of the country). Hence, it is clear that this type of monetary and banking system relies on exponential growth in interbank liabilities – without it, confidence collapses, bank liabilities become increasingly illiquid, and the whole system breaks down.

Throughout history, there have been two truly major innovations in “financial technology” and in the actual mechanics of how the monetary and banking system operates: double-entry accounting and the establishment and evolution of the modern international wholesale Eurodollar banking system. Both of these innovations were invented and implemented to solve what was basically a liquidity problem.

Double-entry accounting allowed transactions to be conducted through ledger entries and settled only periodically in bullion or currency, which significantly increased the sophistication and complexity of credit extension techniques. Double-entry accounting was more than a simple switch from gold to paper. Double-entry accounting characterized the ability to conduct and settle transactions in “IOUs,” as opposed to bullion or currency, so that the accessibility of bullion or currency became much less of an obstacle to economic activity. Suddenly, it became much easier to buy and sell farmland, invest in ventures, and conduct and settle business transactions in general, as all these economic activities could be done now “at the stroke of a pen.”

The wholesale Eurodollar banking system, connecting the world’s economies using a single operating framework of protocols for the first time in human history, took this to a whole new level. Moreover, the wholesale Eurodollar banking system also opened up and freed banking operations from the ledgers of a few large Italian merchant banks to include dozens to hundreds of financial institutions that provisioned balance sheet space to facilitate business transactions. As the world became increasingly interconnected, we went from having only a handful of wealthy banking families being capable of providing capital to would-be entrepreneurs and growing enterprises to hundreds of thousands of small, medium, and large banks all being capable of providing capital to almost anybody. Along the way, we also developed a true international securities market, which further broadened effective balance sheet space upon which credit could be provisioned – but at a cost.

The problem with the development of the securities market is that it transformed the risk equation to focus less on the actual outcomes of business operations (as it would with a loan or illiquid equity investment) and more (almost exclusively) on capital gains. In the process, this behavior distorted and perverted incentives to fund/finance businesses. However, for as long as the financial system, especially banks, are able and willing to expand their balance sheets, a lot of these problems can be temporarily papered over. Economic growth tends to fix most problems after all.

However, in the post-GFC period, the wholesale funding/financing model of large banks, which has developed on borrowed time over the past 60-70 years, has proven, once and for all, to be fundamentally fragile in its very existence. Now, there is no more profit to be made, since the entire thing is essentially equivalent to a spinning top that maintains an illusion of stability so long as it spins fast enough for it to not fall over. The choice that banks must make now has become very clear: use a little bit more short-term wholesale funding/financing to police and arbitrage spreads to make a little bit more profit or just hoard liquidity and stay solvent.

Maybe, because of its efficiency, the Euro-currency market has an exceptional potential for expansion which may create a special problem for monetary authorities in the future.1

The situation could be particularly serious because the Euro-dollar market had become an increasingly important source of financing for industrial and commercial enterprises not only in Europe but in the whole world. One bankruptcy could attract a lot of attention, and if it led the European commercial banks that had been supplying funds to the market to reassess the credit risks they faced, the result might be a sudden scramble for liquidity. The chances of such a development were enhanced by the fact that no central bank had formal responsibility for the behavior of the Euro-dollar market.2

The fact that to the extent that there is stigma [about the Primary Dealer Credit Facility (PDCF)], they are not going to want to come, and that is going to reinforce the deleveraging process that is clearly under way, as is the fact that they just saw Bear Stearns go from a troubled but viable firm to a nonviable firm in three days. The lesson from that for a lot of firms is going to be, oh, I need more liquidity, I need to be less leveraged, and that lesson, from what happened to Bear Stearns, isn’t going to go away.3

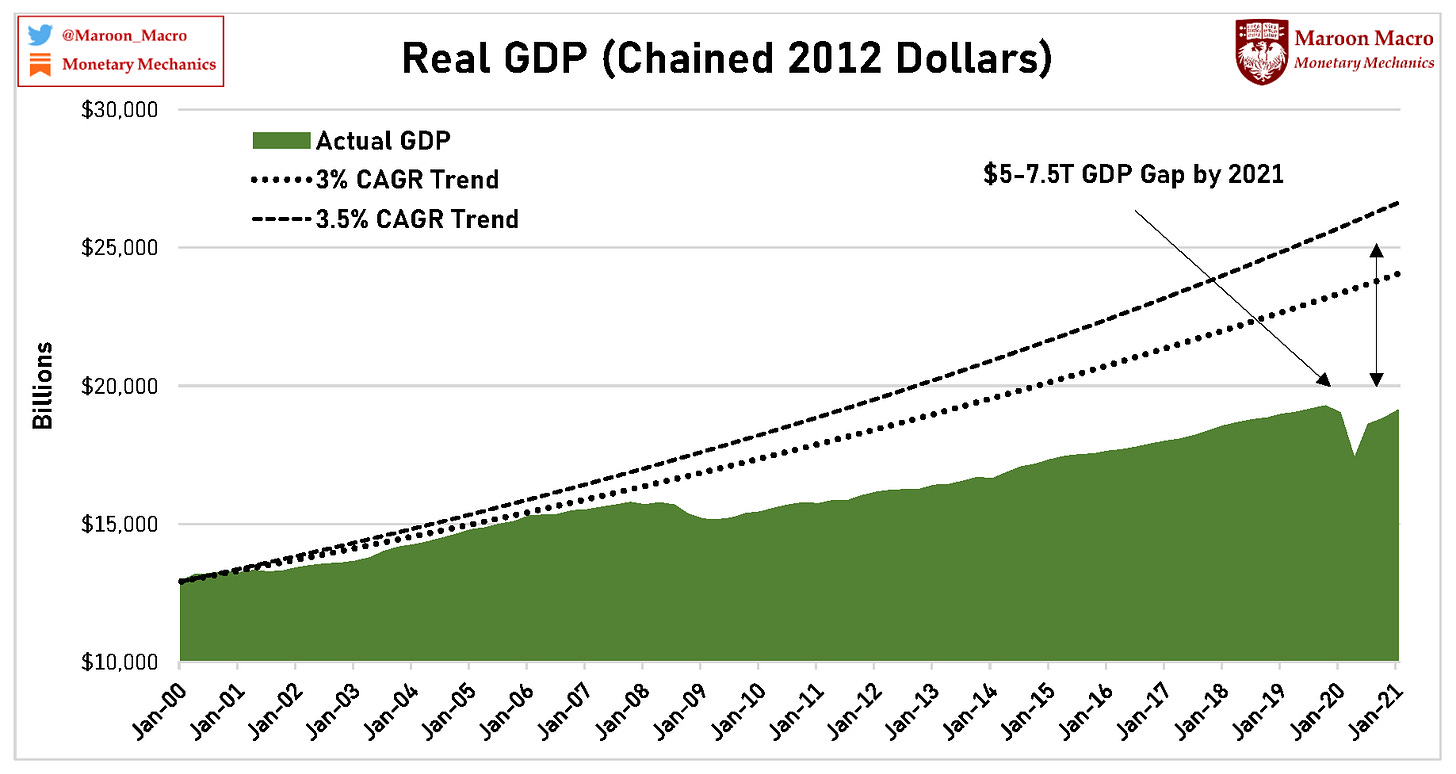

The informal interbank networks that form the backbone of the modern monetary and banking system have slowly started to back away from their crucial roles as the ledger keepers. Consequently, the outcome is a broken monetary and banking system and an economy that remains stubbornly stunted and incapable of growth.

Total Credit Volume Across Market Regimes

Most of the people who operated the monetary and banking system are gone now after being laid off from the Fixed Income Currencies and Commodities (FICC) departments at large banks from 2014 onwards. Now, we have to deal with this dead husk of a monetary and banking system that cannot and will not function as necessary for the economy to grow due to the inelasticity of effective bank balance sheet capacity.

DeFi changes the game by circumventing the problem (i.e. banks and primary dealers) in its entirety and directly connecting those who need capital and those who are able and willing to provide capital. The basic problem with centralization is not only from an individual and property rights perspective (e.g. wanting to “own” or have custody of one’s own assets), but also, more importantly, its inefficiency, rooted in the intermediary need for balance sheet capacity for transactions to occur. If that intermediary need for balance sheet capacity can be outsourced to the whole world, instead of depending solely on large dealer banks, a lot of trapped productivity can be unlocked, which would push the economy closer to its efficient frontier.

DeFi enables such an outsourcing to occur by eliminating the need for a trusted central intermediary and allowing borrowers and lenders to come together and connect with each other directly through software and smart contracts that take the place and play the part once occupied by trusted central intermediaries.

Think about how much potential GDP was (and still is) wasted because entrepreneurs and enterprises with good ideas, like Nikola Tesla, never got properly funded. Think about how many people felt inspired to but never tried to invent something because they were not sure, maybe even pessimistic, about their funding opportunities.

In the long run, even if many people fail in their endeavors, it is far better for the economy, as well as society as a whole, if more people are able and willing to take real risks and invent/innovate, rather than just relying on these centralized financial institutions to decide who does and does not deserve to get funded. What a lot of people do not realize is that these centralized financial institutions do not have perfect foresight, are risk-averse, and are operating under clearly suboptimal conditions.

This transformation is already bleeding in through the edges and cracks of the traditional financial system: financial technology (FinTech) is doing direct lending because banks are unable or unwilling to, direct listing for IPOs is becoming increasingly popular, new methods of payments are beginning to supersede traditional wire transfers, etc. However, I do not believe that this transformation can proceed successfully within the boundaries of the problematic traditional financial system.

In my personal opinion, the transition from the present financial system to whatever form of it awaits us in the future will be far more revolutionary than simply changing which global hegemony within the same (dangerously crippled) monetary and banking system happens to hold the claim to the “world reserve currency.” The transition from the pound sterling to the US dollar during the interwar years was nothing more than this – a simple changing of which national currency gets to play the dominant part within the same monetary and banking system.

This transformation from TradFi to DeFi will be a system overhaul similar to the developments of double-entry accounting and the modern international wholesale Eurodollar banking system – it will revolutionize the “financial technology,” the entire system of standards, with which the world’s monetary and banking system operates: how credit is extended, to whom it is extended, for what purpose it is extended, for how long it is extended, what the means of repayment are, how repayment is ensured, who is able to borrow, who is able to lend, how ownership is defined (collateral reuse makes this very complicated), and so on and so forth.

The ironic thing is that most crypto enthusiasts are completely correct in their judgment that the current monetary and banking system is broken, but most are wrong about how it is broken. DeFi is extraordinarily elegant in the way in which it reenables elasticity in the machinery of exchange. I have included below a particularly informative video that showcases some potential use cases. While its coverage of TradFi is a tad superficial, I believe that the potential of DeFi is well-demonstrated in it.

All these projects are in their infancies and will, no doubt, take significant time to fully mature. There is also no doubt that many, if not most, of these projects will go bankrupt over a long time horizon. We will witness far more AOLs and MySpaces than Microsofts, Googles, and Apples. Furthermore, the industry has to survive what seems like an imminent wave of regulation and legislation that has the potential to either crush what fledgling growth has occurred so far or create a solid foundation that can be further build upon in the future. I do not know which projects will ultimately succeed and endure the test of time, but I will continue to watch this space very closely.

Minutes from the Federal Open Markets Committee, 1964. This quote was from a study done by the Bank for International Settlements, and read allowed at the time, but such study is not available/accessible in archival records today.

Minutes from the Federal Open Markets Committee and its Executive Committee, January 14, 1969.

https://www.federalreserve.gov/monetarypolicy/files/FOMC20080318meeting.pdf

I have read all your writings and I'm fascinated by all the history and mechanics of the banking system. Jeff Snider brought me to the Eurodollar mechanics 2 years ago and I'm trying to learn more since that. So thanks for your educational content.

PS: I'm in the Bitcoin space since 2016 and I'm impressed by your openness to the Defi and Crypto Ecosystem. We live in a world where Bitcoiners and Crypto enthusiasts are all for "FED prints money", "hyperinflation" etc, and No-Coiners and TradFi enthusiasts shout out "Bitcoin is worth zero" "Defi is a scam" etc.

I appreciate these "trying-to-bridge-some-gap" posts ;) thanks

Fantastic! Thank you. Eurodollar University (emil and Jeff) brought me here.