In this issue of Monetary Mechanics, I am going to cover all the different facets of the US repo market, beginning with the nuanced division between the tri-party and bilateral repo markets, as well as the evolution of both repo markets since the GFC. I believe it might be helpful to clarify the subtle differences between these fundamentally similar repo markets, especially since post-GFC legislations/regulations and market innovations have significantly changed the structure of the entire repo market. In this issue of Monetary Mechanics, I am going to focus primarily on the US repo market, as opposed to the global repo market.

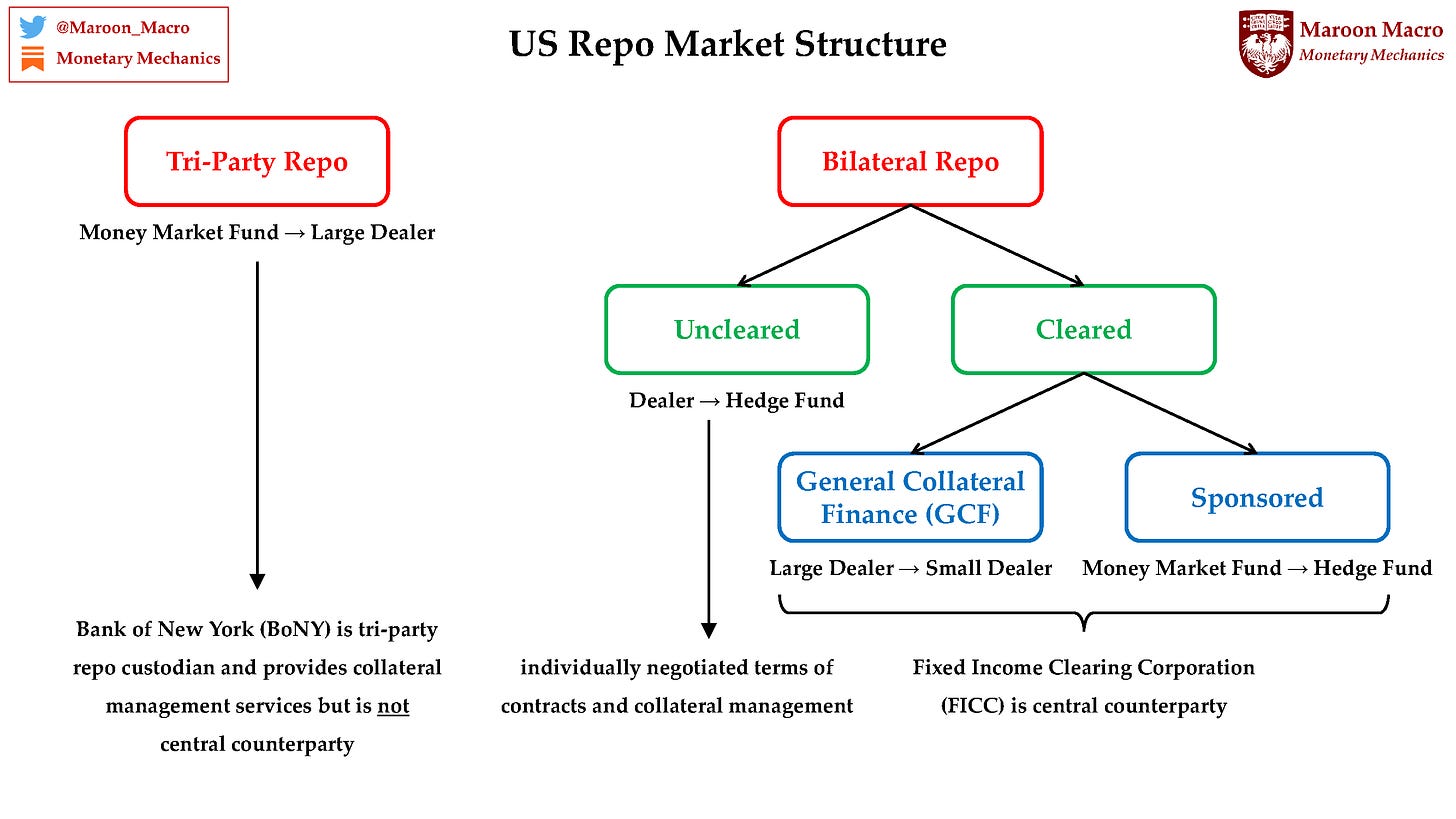

From a high-level perspective, the “repo market” is not actually a singular monolithic market – it is composed of several smaller markets, each with different participants, regulations, regulatory oversight, and collateral eligibility. I will start with the tri-party repo market, as it is the most visible and well understood, then work my way towards the more opaque corners of the repo market. However, much of what I will say about the uncleared bilateral repo and securities lending markets will be merely inferences made with limited information, since data availability/accessibility for that specific segment of the repo market is limited.